How To Make Money With Options Using Charts

Selection Profit/Loss Graph Maker

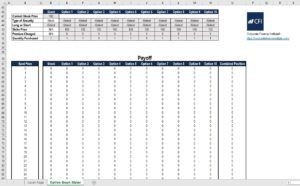

This choice profit/loss graph maker lets the user create option strategy graphs on Excel. Up to ten different options, as well every bit the underlying asset can be combined. As well as manually being able to enter data, a number of pre-loaded pick strategies are included in this workbook. To use these pre-loaded buttons, macros must exist enabled.

To download this free option graph maker check out the CFI Market place: Option Turn a profit/Loss Graph Maker

Below is a brief preview of CFI's option profit/loss graph maker:

The above image shows a synthetic telephone call option , one of the pre-loaded trading positions in this workbook. To the right of the graph, any of the buttons can be selected to preview an example of the option strategy.

The solid dark blue line on the graph shows the profit /loss of the combined positions. The dotted lines show the profit/loss of the options and underlying nugget. Beneath is an instance of an atomic number 26 butterfly spread. Using this option profit/loss graph maker, yous can actually visualize why the atomic number 26 butterfly spread has its name.

The "Reset Values" button will clear any values being shown in the graph. From there, the user can too manually input values into the table below the graph. Alternatively, an choice strategy tin can exist selected from the list of buttons as a starting point and the values in the tabular array can exist altered to conform the user's needs. The greyed boxes represent variables the user can input data into:

This option profit/loss graph maker allows the user to:

- Modify the Current Stock Price

- Combine up to 10 Dissimilar Options

- Cull whether to Long or Brusk the Stock or Options

- Choose the Quantity of Each Option or Stock Beingness Purchased or Sold

- Choose the Strike Price of Each Option

- Choose the Premium Being Charged

The trading strategies that come pre-loaded into this workbook include:

- Synthetic Positions

- Synthetic Long Stock

- Synthetic Short Stock

- Synthetic Long Call/Protective Put

- Constructed Short Call

- Synthetic Long Put

- Synthetic Short Put/Covered Call

- Directional Strategies

- Collar

- Bull Call Spread

- Bear Call Spread

- Bull Put Spread

- Acquit Put Spread

- Non-Directional Strategies

- Long Straddle

- Long Strangle

- Long Call Butterfly

- Short Call Butterfly

- Long Put Butterfly

- Short Put Butterfly

- Iron Butterfly

- Opposite Iron Butterfly

- Iron Condor

- Jade Lizard

- Long Guts

Synthetic Positions

Synthetic positions are portfolios that agree multiple securities that when taken together, emulate another position. These positions are usually created to alter an existing trading position. Synthetic positions can also assist traders reduce transactions necessary to change a position or to identify potential mispricings in the market.

Synthetic Long Stock

A synthetic long stock is created with a long position on the telephone call option and a brusk position on the put option. This trading position tin can be created to emulate the corresponding asset, however, information technology will involve lower initial majuscule requirements.

Synthetic Brusque Stock

A synthetic brusk stock is created with a brusk position on the phone call option and a long position on the put option. This trading position can be created to emulate a short position on the underlying nugget. The benefit, similar the synthetic long stock, are lower initial capital requirements. There is also the benefit of non needing to consider dividends like in the actual short-selling position of the stock.

Synthetic Long Call/Protective Put

The synthetic long phone call is created by holding a long position on the asset and a long position on the put option. This trading position emulates a long telephone call choice. Often this position is created when a trader is already holding either the asset or the put option . If they are holding the asset and believe that prices may autumn, they can purchase the put option hence the alternative name protective put . If a trader is belongings the put option considering they thought prices would fall, just expectations change, instead of selling the put they might buy the nugget, which creates the synthetic long call and lowers transaction costs .

Synthetic Short Telephone call

A synthetic short call is created through a curt position on the underlying asset, and a curt position on the put option. This trading position emulates a short call position. Often this position is created to alter an existing one to reduce transaction costs. For example, if a trader wants to change their position from a short put to a short phone call, they tin simply short the underlying asset rather than closing the put position and opening the call position.

Synthetic Long Put

A constructed long put position is created by holding a short position on the underlying asset and a long position on the telephone call option. This trading position emulates a long put position. Again, a synthetic long put is oft created to change an existing position. If a trader is holding a long call position and wants to switch to a long put, they can but short the underlying nugget. This is preferable to closing the call option and buying a put since it reduces the number of transactions, which in plow reduces costs.

Synthetic Short Put/Covered Phone call

A synthetic short put position is created by holding the underlying asset and shorting the call option. This trading position emulates a brusk put position. The synthetic short put can be created to alter an existing position. This position is also referred to as the covered call . Investors tin sell phone call options to generate income, and past holding the underlying nugget, they are covered if the price of the underlying nugget increases and the options are exercised.

Directional Trading Strategies

Directional trading strategies are bets on whether the underlying asset will increment or decrease in value. These strategies are used when a trader believes they can predict the direction of the market or underlying nugget.

Collar

A collar is created by selling a call option, holding the underlying asset, and buying a put option. it can be idea of as a simultaneous protective put and covered telephone call . A collar limits both the downside loss and upside proceeds. Collars are often used when the underlying asset has increased significantly in price and an investor holding this asset wants to protect this unrealized gain.

Bull Call Spread

A bull phone call spread is created past holding a long position on a call option and selling a call choice at a higher strike price . The investor will gain if the nugget increment in price, however, the upside gain is capped past the short call option. A balderdash call spread is employed when an investor believes the price of the corresponding nugget will increase by a limited corporeality. The short telephone call option premium can be used to cover function of the toll of the long call.

Bear Phone call Spread

The bear call spread is created by shorting a telephone call selection with a lower strike price and holding a long telephone call with a college strike cost. This strategy is also called a credit call spread since it generates a net credit when first opened. the comport call spread is by and large used to generate income if the asset toll is expected to subtract or stay stable.

Balderdash Put Spread

A bull put spread is created past buying a put option and selling a put option at a college strike price. This option strategy is used when a trader believes the asset will movement slightly higher in cost. This strategy can be used to generate income and will consequence in a net debit when opening the position.

Bear Put Spread

A conduct put spread is created past selling a put option, and buying a put option at a higher strike toll . This strategy is used when a trader believes that the price of the asset will fall. The gains are capped as the asset decreases in price but the losses are also capped as the nugget increases in toll.

Non-Directional Trading Strategies

Non-directional trading strategies bet on the volatility of the underlying asset. The direction the asset value moves will generally exist much less important in these trading strategies. At that place are however exceptions that do consider the management of the asset price in these strategies. Non-directional strategies are used when a trader believes an asset will take either very low volatility or high volatility but they do not know in which direction.

Straddle

A long straddle is created by buying an at-the-money call option and an at-the-money put option. The event is a internet credit and the investor will gain from a big swing in price either upwards or downwards. Traders who believe at that place is high volatility but practice not know which management the nugget will movement in may employ a straddle.

A brusk straddle is created by selling an at-the-money call option and at-the-money put pick . This results in a net debit, however the investor has unlimited upside and downside loss potential.

Strangle

A strangle is like to a straddle. Instead of ownership the call and put option at-the-money, they are both bought out-of-the-money. Since both options are out of the money, the cost of a strangle is generally less than a straddle, however, it requires greater volatility to profit from. Investors who believe there is high volatility may apply a strangle.

A curt strangle is created by selling an out-of-the-coin phone call choice and out-of-the-money put option. This strategy is similar to a brusque straddle. It results in a net debit lower than the brusque straddle, however, the debit is held at a greater range for the corresponding asset toll.

Call Butterfly Spread

A long call butterfly is created past ownership an in-the-money call choice, selling two at-the-money telephone call options and buying an out-of-the-money telephone call pick. This results in a net debit when opening this position. Every bit the nugget price moves in either direction, this position will fall in value, however, the upside and downside losses are capped. A trader volition employ a butterfly spread when they believe the underlying asset will feel very footling volatility.

A short call butterfly is created past selling an in-the-money call option, buying two at-the-money phone call options and selling an out-of-the-money call option. This results in a net credit, however, the investor volition gain from upside or downside. The upside or downside gain in a short call butterfly is capped. An investor might apply this strategy if they believe the underlying asset will experience loftier volatility .

Put Butterfly Spread

A long put butterfly is constructed by buying an out-of-the-money put option , selling ii at-the-money put options and ownership an in-the-money put option. This results in a net debit. The long put butterfly spread gives a payoff very similar to the long call butterfly, however, information technology is synthetic with put options rather than telephone call options. An investor will employ this strategy when they believe the underlying asset will experience very lilliputian volatility.

A short put butterfly is created past selling an out-of-the-money put option, buying two at-the-money put options, and selling an in-the-coin put option. The turn a profit/loss graph of this strategy is very similar to a short call butterfly spread, withal, it is constructed with put options rather than call options.

Iron Butterfly

A long iron butterfly is created by buying an out of the money put option, selling an at-the-coin put option, selling an at-the-coin phone call pick, and buying an out-of-the-money telephone call option. This strategy can also be thought of as a combination of a acquit put spread and a bull call spread.

The profit /loss of this strategy is very like to the long call butterfly and long put butterfly spread. The payoff volition be highest between the lower and higher strike prices. A trader might utilise an iron butterfly if they believe the underlying nugget will feel very footling volatility .

The reverse atomic number 26 butterfly or short iron butterfly spread is created by selling an out-of-the-money put option, buying an at-the-money put option, ownership an at-the-money call selection, and selling an out-of-the-money call option. This will consequence in a very similar profit/loss graph as the short put butterfly and short telephone call butterfly spread. The investor volition start with a net credit when opening this trading position, however will benefit from the corresponding asset toll moving upwards or downwardly.

Fe Condor

The iron condor strategy is constructed by buying an out-of-the-money put pick , selling a slightly out-of-the-money put selection with a college strike price, selling a slightly out-of-the-money call option and buying an out-of-the-money phone call option with a college strike cost. The iron condor is similar to the iron butterfly, however, the initial net debit is lower.

The values in which the iron condor results in a profit is generally larger than the atomic number 26 butterfly. A trader may use an fe condor if they believe that the underlying asset volition experience very low volatility. An fe condor may be employed over an iron butterfly if the trader is less sure well-nigh how stable the asset price will exist.

Jade Lizard

The jade lizard is constructed by selling a put option with a lower strike price , selling a phone call selection with a higher strike price, and buying a call option with an even college strike price. The jade lizard attempts to take advantage of the volatility skew. This means that the out-of-the-money put should merchandise with a higher premium to an equidistant out-of-the-money call. The jade lizard will try to collect a premium from low volatility while likewise eliminating upside gamble . This strategy is slightly bullish in direction since the downside run a risk is not eliminated.

Guts

A long guts option strategy is similar to strangle, all the same instead of constructing it using out-of-the-money options, information technology is created by ownership an in-the-coin telephone call pick and buying an in-the-money put option . The premiums that are paid will result in a net credit. This strategy will profit from a big swing in price upward or downwards. Like to the strangle, traders may employ this strategy when they believe the underlying asset will feel loftier volatility.

Related Readings

Thank you for reading CFI'south guide on Option Profit/Loss Graph Maker. To continue developing your career as a financial professional, cheque out the following additional CFI resources:

- Types of Markets – Dealers, Brokers and Exchanges

- Long and Short Positions

- Options Case Study

- Ownership on Margins

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/option-profit-loss-graph-maker/

Posted by: klattmort1951.blogspot.com

0 Response to "How To Make Money With Options Using Charts"

Post a Comment